Rock Health Funding Reports

Rock Health publishes quarterly, midyear, and year-end funding reports which analyze trends in healthcare investment activity. These reports cover traditional funding metrics such as deal size and funding activity while providing specific insights from Rock Health’s network of investors and digital health experts. Rock Health’s Funding Reports are their most widely read and cited publications.

2023 Q1 Report

“2023 started off with the hallmarks of a rebound year. While Q4 2022 signaled the tail end of the digital health funding cycle, January and February funding numbers began to suggest that sector investment was slowly but surely inching back upwards. Inflation was easing ever so slightly. Investors were rediscovering their confidence and launching new projects, signaling optimism in the sector.”

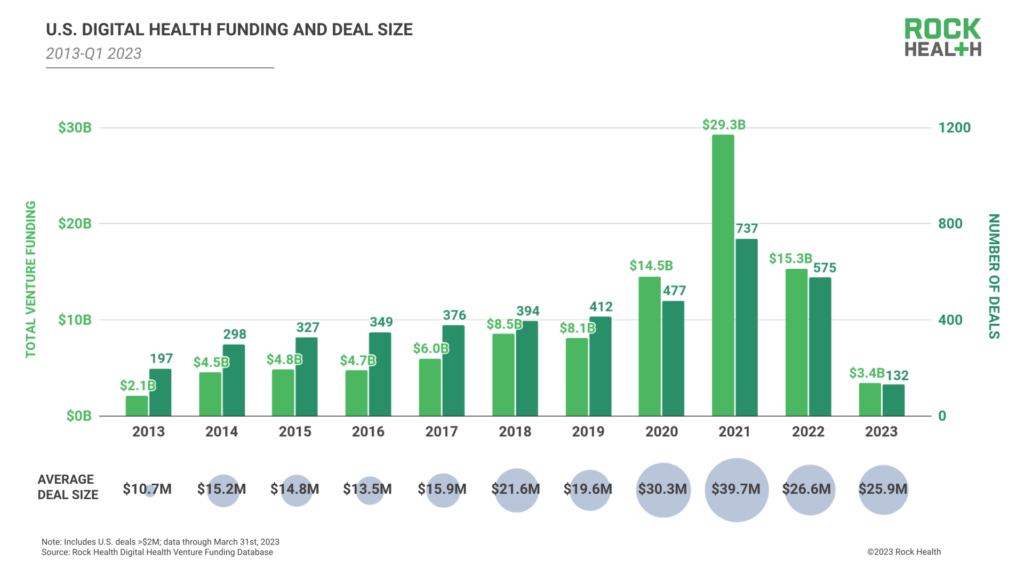

“Q1 2023 U.S. digital health funding closed with $3.4B across 132 deals, with an average deal size of $25.9M. While this quarter exceeded both Q4 2022’s $2.7B and Q3 2022’s $2.2B funding pots, Q1 isn’t enough to signal a new “bull run.” If funding for the next three quarters matches the average funding across the prior three quarters, 2023 is on pace for the lowest level of annual funding since 2019. The truth remains that the founder-friendly market of 2021 and early 2022 has tilted sharply toward investors.”

Read the Rock Health 2023 Q1 Report

Past Reports

Rock Health 2022 Year-End Report

Q3 2022 digital health funding: The market isn’t the same as it was

2021 year-end digital health funding: Seismic shifts beneath the surface

2020 Market Insights Report: Chasing a new equilibrium

In 2019, digital health celebrated six IPOs as venture investment edged off record highs

2018 Year End Funding Report: Is digital health in a bubble?

Rock Health Digital Health Consumer Adoption Reports

Through years of research, Rock Health identified the consumer space in digital health as one of the most challenging categories for investors. In 2015, Rock Health launched a landmark consumer adoption survey to help provide investors and stakeholders with greater insights into this challenging area. The survey has continued on an annual basis with findings generally published in the summer.

Digital Health Consumer Adoption of Telemedicine in 2021

Nearly two years into the COVID-19 pandemic, more consumers have used telemedicine than ever before. Venture investment in telemedicine is up, and big and small players are making land grabs for their share of the market, with many rolling out virtual–first care offerings. So with these accelerants—balanced with the full return of in-person care—what’s the state of telemedicine?

To answer this question and many more, we have surveyed U.S. adults every year since 2015 to check in with consumers and their relationship to digital health. Rock Health’s Digital Health Consumer Adoption Survey (hereto referred to as the “Survey”) is a U.S. Census-matched sample of adults age 18 and over—with a distinct group of adults surveyed each year. Respondents used their personal desktop, laptop, smartphone, or tablet to complete the survey in English. In both 2020 and 2021, 7,980 U.S. adults were surveyed each year in the summer to fall timeframe; in previous years, we surveyed approximately 4,000 U.S. adults annually. For statistical analyses, we used logistic regression to determine the association between a primary predictor and outcome of interest, controlling for covariates (i.e., confounders) in multivariate regression analysis.

Read the Rock Health Digital Health Consumer Adoption of Telemedicine in 2021

Past Reports

Rock Health Digital Consumer Adoption Report 2019

Beyond Wellness For the Healthy: Digital Health Consumer Adoption 2018